Mebco Submission On Ontario Ministry Of Finance Proposal For A Permanent Framework For Target Benefits

MEBCO has engaged with the Ministry of Finance (MoF) in many ways since the March 15th release of the Proposal for a Permanent Framework for Target Benefits. MEBCO’s engagement included meetings with policy advisors at MoF, the Minister of Finance and other Ministers.

MEBCO’s position is that MoF has the benefit of the mistakes made in other provinces, notably British Columbia and Alberta, and should therefore take advantage of that learning. MoF must also realize that target benefit plans are governed by a fiduciary board of trustees and regulations should be principles- based and thus should not prescribe specific board actions.

MEBCO is pleased to see that the proposed framework will, finally, over-ride the current Ontario requirement that commuted values be paid on a solvency basis and will be paid, prospectively on the going concern basis. However, we note that the proposal does not allow the trustees to apply the plan’s funded ratio to the commuted values, which is allowed under the Canadian Institute of Actuaries’ professional standards. The current Ontario position that our plans pay commuted values based on solvency is regressive, not endorsed by the Canadian Institute of Actuaries, out of step with all other major jurisdictions and costs multi-employer pension plans (MEPPs) and their members millions of dollars every year.

Here is a summary of MEBCO’s other key concerns about the MoF proposed framework released March 15, 2023:

- The PfAD- provision for adverse deviation.

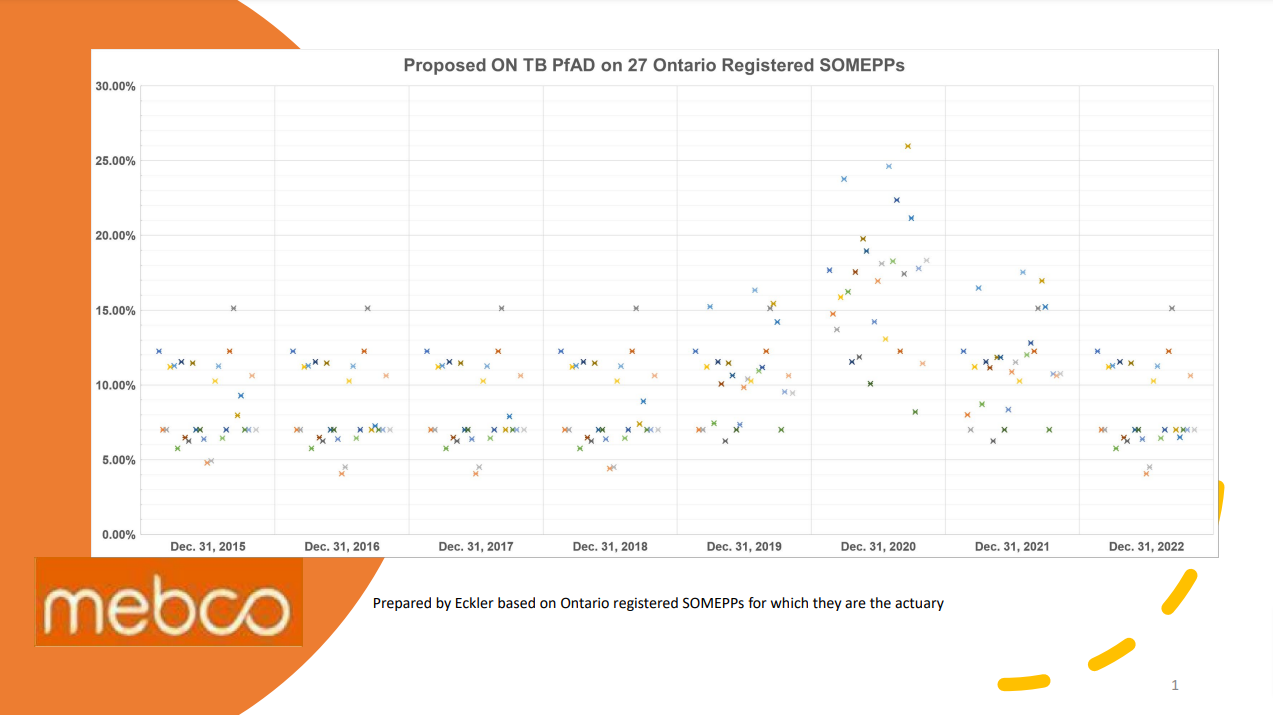

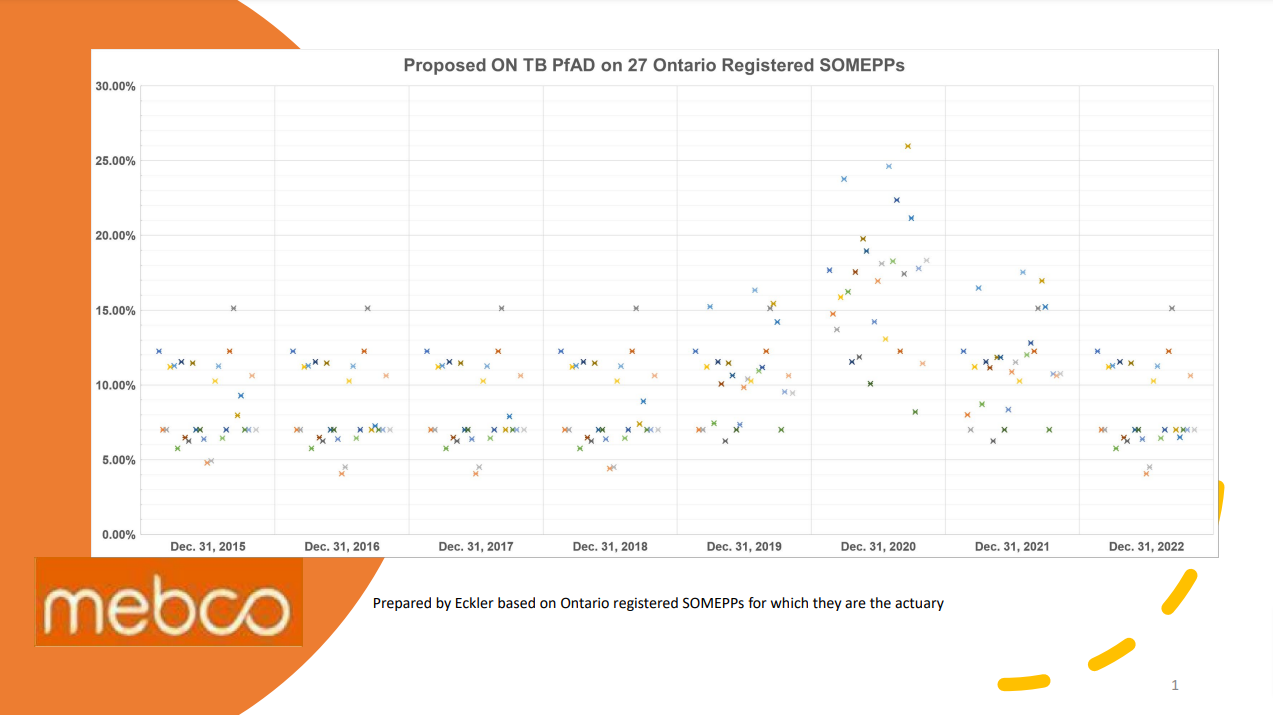

- We have seen no evidence MoF did any real back-testing of the impact of its proposed formula on Ontario MEPPs. MEBCO’s broad and detailed back-testing which included a large portion of plans in Ontario shows substantial swings in the amount of margin required for a pension plan – swings of over 15% for a number of plans and PfADs as high as 25%. (See attachment based on Ontario registered SOMEPPs prepared by Eckler Ltd. This was provided in our meeting with MoF representatives held April 28, 2023.)

MEBCO’s position is that any PfAD should be determined by the applicable plan's board of trustees.

- Contribution Sufficiency

- MoF’s model doubles down for pension plans that require a PfAD and have experience losses that are being amortized.

- MEBCO’s position is that only the greater of the PfAD or the experience loss being amortized is added to the normal cost.

- MEBCO’s position is that experience losses being amortized should be reset with each valuation.

- Use of Surplus

- MoF’s proposal prohibits the use of surplus to fund a plan’s normal cost or PfAD.

- MEBCO’s position is that this is an arbitrary and prejudicial rule that is also not equally applied to single employer plans which can use surplus to fund the normal cost yet have a higher risk of failure than MEPPs.

- MEBCO’s position is that the fiduciary board of trustees should decide how to use surplus including to fund the normal cost or PfAD.

- Communications

- MoF’s proposal requires that plans advise members of benefit changes that have taken place over the last 10 years in communications to new members and in annual benefit statements.

- MEBCO’s position is that similar communications are not required in other jurisdictions or for single employer plans or jointly sponsored pension plans and is an unnecessary burden which creates a negative perception of the plans. Plans are already required to provide communication around recent changes.

- MoF’s proposals require continued communication of transfer ratios whereas this information is not applicable.

- MEBCO’s position is that transfer ratio/solvency ratio information is not required in the target benefit framework.

- MEBCO supports that each plan have a communication policy that is appropriate for the plan and its resources.

- Governance

- MoF’s proposal is that plans have a funding policy and governance policy.

- MEBCO’s position is that this is reasonable and that most plans have these in place already. However, MEBCO wants to ensure that the policy detail aligns with plan size and resources. MEBCO agrees that pension plan actuaries should perform risk measures and scenario analysis as prescribed by the Canadian Institute of Actuaries, with additional analysis being discretionary.

- MOFs proposals diminish the role of fiduciary boards of trustees that have the ultimate responsibility for the plan. MoF proposals for example require that boards reinstate any past benefit reduction before a benefit improvement can take place. MoF’s proposals do not take into account the due diligence performed by boards before changes are made, including consideration of funding and industry risk. MoF’s proposals do not consider that for some plans benefit improvements or reductions are voted upon by plan membership.

- MEBCO’s position is that there should be no prescriptive measures for boards of trustees around benefit improvements or restorations.

- Plan Amendments and Restorations

- MoF’s proposal is that plans must restore any earlier benefit reduction before any improvements to benefits are made.

- MEBCO disagrees with MoF’s proposal as requiring benefit restorations ignores the due diligence of fiduciary boards of trustees in making benefit reductions including prospective changes to benefits to ensure benefits are aligned with, for example, capital market expectations and industry risk. MoF’s proposal also does not acknowledge that, in some cases, benefit improvements or reductions are voted on by the plan’s membership. MEBCO believes the fiduciary board of trustees that approves the plan amendment should be the responsible party in determining any benefit provided by a target plan.

- Conversion

- MoF’s proposal provides for a communication that a pension plan is becoming a target benefit including communications to employers, bargaining agents, members and others.

- MEBCO’S position is that the plans that would be “converting” have been target plans for decades and that nothing is changing for the members of the plans or the employers. MEBCO believes plans should simply signify they have accepted the new legislated framework by signifying this on their annual information return filed with FSRA.

- Multi-Jurisdictional Agreement

- MoF’s proposal requires that plans are only allowed to provide target benefits if no more than 10% of their membership is in a jurisdiction that does not allow reductions in benefits.

- MEBCO’s position is that this provision will be very difficult to administer and that the current CAPSA multi-jurisdictional agreement, to which Ontario is a signatory, should not be superseded by the MoF proposal.

About MEBCO

MEBCO was established in 1992 to represent the interests of Canadian multi-employer pension plans (MEPPs) and health benefit plans (MEPs) with provincial and federal governments regarding proposed or existing legislation and policies affecting these plans. MEBCO is a federal no-share capital corporation, operating on a not-for-profit basis.

MEBCO is representative of all persons and disciplines involved in MEPPs and MEPs, including union and employer trustees, professional third-party administrators, non-profit or "in-house" plan administrators, professionals including actuaries, benefit consultants, lawyers, and chartered accountants. MEBCO is administered by a volunteer Board of Directors consisting of representatives from each of the above groups. MEBCO represents all stakeholders in target benefit multi-employer pension plans (MEPPs) – employers, unions, and professionals, defined contribution pension plans and group RRSPs. MEBCO’s MEP members provide a broad range of health care benefits to members including insured and self-funded benefits.

Multi-employer pension plans (MEPPs) and multi-employer benefit plans (MEPs) are typically administered by a fiduciary board of trustees. The trustees in most MEPPs and MEPs are appointed by some combination of the trade union(s) representing plan members and employer association(s) representing the participating employers.

Thank you for this opportunity to provide comment on this very important matter. If it would be of assistance, we would be pleased to meet with you to discuss these issues further.

Yours truly,

Alex McKinnon, President

Main Submissions Page